by Alejandro Cardot | Jun 22, 2022 | Uncategorized

Promoting Private Debt to Retail Investors While Stretching The Value of Financial Assets, with KPMG’s “Seal of Approval” “How value is determined – and who gets to do the determining – can make the difference between fortunes won and lost. As with all such...

by Alejandro Cardot | Mar 16, 2022 | Uncategorized

Will KPMG seize their second chance with Canadian private debt investors? The audit firm faces a tough decision “Auditors are supposed to know the business they are auditing, including the general economic, business, and fundraising environment. But they should look...

by Alejandro Cardot | Sep 15, 2021 | Uncategorized

Lessons from Bridging: How to Scrutinize a Private Debt Fund – Part II “How many red flags are enough to walk away from an investment? One should be enough; anything past one is overkill.” — Harry Markopolos (Madoff’s whistleblower) Private...

by Alejandro Cardot | Aug 3, 2021 | Uncategorized

Lessons from Bridging: How to Scrutinize a Private Debt Fund – Part I “Stay curious, stay skeptical” – Ken Lester Many investors and advisors were surprised after a court placed Bridging Finance into receivership. Some investment professionals...

by Alejandro Cardot | Jul 16, 2021 | Uncategorized

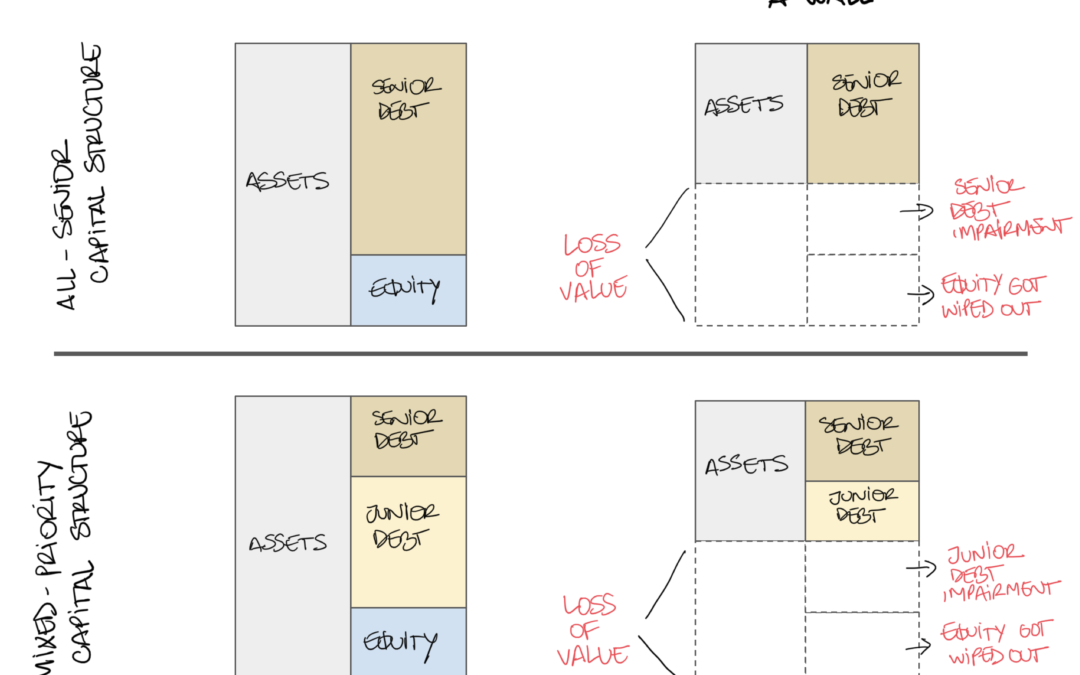

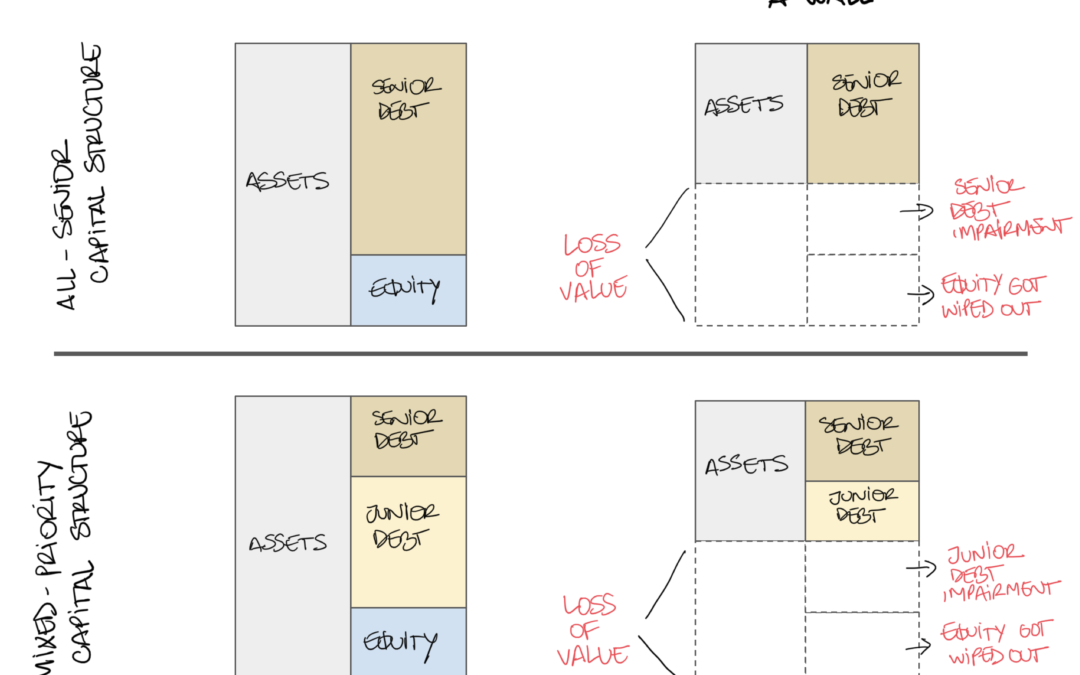

Lessons from Bridging: The Myth of Senior Security “Lenders are used to the idea that so-called ‘first-lien’ debt grants them priority over the borrower’s assets should it go bankrupt. But Moody’s analysis of defaults during the pandemic shows that first-lien lenders...