Promoting Private Debt to Retail Investors While Stretching The Value of Financial Assets, with KPMG’s “Seal of Approval”

“How value is determined – and who gets to do the determining – can make the difference between fortunes won and lost. As with all such circumstances, if there is big money on the line, there will be people with the means, opportunity, and motive to stretch the boundaries and grab more than their fair share of it.” — Doomberg

The collapse of Bridging Finance illustrates how an investment manager can manipulate the reported value of financial assets. Today Bridging Finance is a synonym for an investment loss. To my surprise, I found someone fooling themselves by reporting a nine-figure investment in Bridging’s funds without any impairments.

Vancouver-based Harbourfront Wealth recently announced a transaction where Audax Private Equity invested a “nine-digit” amount in the company. Harbourfront CEO, Danny Popescu, attributed its current success to their “approach to diversify beyond traditional asset classes.” The company claims that “every client at Harbourfront can access a shelf of customized, retail-friendly, private securities.”

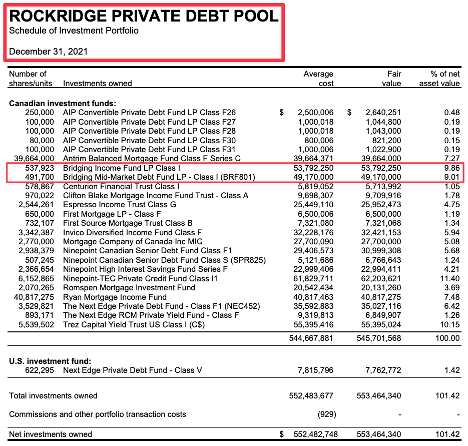

One of those “opportunities” is Rockridge Private Debt Pool, a fund managed by Willoughby Asset Management — a subsidiary of Harbourfront. Rockridge is a fund of funds focused on Canadian private debt.

Under the oxymoronic slogan “Increase your return, not your risk” the fund has reported net assets of C$545 million by the end of 2021. Travis Forman, a wealth manager with “two hats,” claims to manage Rockridge and a private real estate fund. He states that “both funds have never seen a negative month of performance.”

During Spring 2022, Forman was interviewed by Wealth Professional. He said that all their portfolios have a “healthy allocation to private credit and private real estate.” By “healthy”, he meant up to a 50% weight. He stated, “we do have the secret sauce, we are reducing volatility of the portfolio.”

The no-negative-month claims should be scrutinized. The fund has 20% of net assets allocated to one notable manager: Bridging Finance. Rockridge was one of the biggest victims of the scandal. This fallout should trigger some questions about Rockridge’s investment process. Either they don’t understand private debt or they didn’t perform due diligence on the underlying assets.

Since Bridging was placed in receivership, Harbourfront and Rockridge have engaged in a series of actions that looks more like a double down on their private credit bet, than acknowledging an investment mistake. Below is a timeline describing several related events.

December 31, 2021 — Rockridge Private Debt Pool reports C$ 101 million allocated to Bridging Finance representing 22.6% of NAV.

April 30, 2021 — Bridging Finance is placed under receivership in the midst of embezzlement allegations. Lawyers for Willoughby Asset Management are among the first ones to appear on Bridging receivership’s service list.

May 25, 2021 — Danny Popescu, CEO of Harbourfront, issues a commentary promoting private debt. Popescu wrote that “the ~ $500 million Private Debt Pool currently available to Harbourfront’s Canadian clients may also soon close to new investors”

May 26, 2021 — Rockridge’s Trust Agreement was amended to authorize the creation of side pockets unit classes.

May 28, 2021 — Rockridge established two side pocket classes (BFI-A and BFI-F), to which were allocated the fund holdings of the Bridging’s funds. The new units were distributed pro rata in accordance with the number of Class A Units and Class F units respectively that were issued at that time.

December 17, 2021 — Bridging’s receiver communicates investor losses at a minimum of $580 million. The amount represents 36% of Bridging’s C$ 1.6-billion loan book.

February 23, 2022 — Bridging’s receiver communicates that total net recoveries are estimated to be in the range of 34% to 42% of the last reported NAV.

April 29, 2022 — KPMG issues its opinion on Rockridge’s financial statement for the year ending on December 31, 2022. The financial statements show a C$ 102,962,250 investment in Bridging’s funds without any impairments.

Rockridge’s manager rationalized the fictitious valuation by using the “last known value, as of March 31st, 2021, due to the suspension of those funds. The values will be updated once the net asset value of the funds are released by PricewaterhouseCoopers, the receiver of Bridging Finance Inc.“ There are no mentions in the audited accounts, not even as a subsequent event, acknowledging the material losses for Bridging’s unitholders. Keubiko explains it best.

As with Bridging Finance and Ninepoint Partners, KPMG is also the auditor for Rockridge. Their latest opinion for the year that ended in 2021, issued on April 29, 2022, said that Rockridge’s “financial statements present fairly, in all material respects, the financial position of the Fund as at December 31, 2021.”

You don’t have to be an expert in investment funds, company restructuring or private debt to identify a material misstatement when someone shows you an investment in a Bridging Finance fund at 100%.

KPMG’s “seal of approval” for Rockridge’s financial statements is another sign of the lack of skepticism within the audit firm. Financial advisors who believe that KPMG provides “an independent verification of the true value of a loan” should reassess their due diligence framework.

If KPMG has no shame in approving a material investment in a Bridging Finance fund valued at 100%, imagine how easy it is for them to accept the proposed valuation for a loan to an insolvent borrower or a “zombie company.” A nice spreadsheet should be enough.

This process of rationalizing imaginary valuations and getting a “seal of approval” allows private debt managers to claim that they are “uncorrelated to the market” while charging millions in fees. When reality hits and they need to produce cash, “one tends to discover just how much truth is in the price carried on the books,” as said by Doomberg. Ask Ninepoint Partners. They claim an “extremely well-positioned portfolio.” But they prefer to engage in a complex “solution” to face redemptions rather than selling a couple of loans to generate liquidity. For some reason, Occam’s razor is not working for Ninepoint.

Adjusting Rockridge’s investment in Bridging at a 40% price will translate into a loss of more than 10% for Rockridge’s unitholders of record as of April 2021. By not impairing the Bridging investment, Rockridge reported a positive increase in net assets attributable to holders of their units during 2021. They even charged investors C$ 470,866 for performance fees. In my opinion, they didn’t deserve it.

Needless to say, Rockridge has restricted redemptions of the side pockets units holding the Bridging assets. They are just a mirage.

I haven’t seen Rockridge’s marketing material. But I believe that the maneuvers with their Bridging investment allow them to disguise their track record — for their Class A and Class F units. However, when I look at the other names in Rockridge’s investment portfolio, I can tell that this will not be the last time they will use a side pocket. Many of the underlying assets of Rockridge’s investment portfolio are material loans to loss-making businesses with an unsustainable level of debt. The underwriting criteria for those loans share many similarities with Bridging’s lending practices.

In his interview, Travis Forman said that his motivation to establish Rockridge was “doing the right thing for the client.” I can only think of a beneficiary of the decision to develop the side pockets and carry the Bridging funds at face value. Not the client. Clients will suffer the incompetence of an investment manager who doesn’t understand the risks of investing with Bridging Finance. The same investment manager has set up their clients for further misery in the private debt space.

“It is not the first mistake that’ll kill you. It’s the second, the third, and the cover-up of all three” — Marianne M. Jennings

Disclaimer: This article is not investment advice and represents the opinion of the author.