Canadian private debt funds … too good to be true?

The currently depressed interest rate environment has pushed investors to hunt for returns in alternative investments. Among those products that offer attractive current yields are private debt or private credit funds. Their reported proposition is simple; premium uncorrelated returns with low volatility. However, it sounds too good to be true.

The fund managers in the space have a common strategy. They lend to good, underappreciated companies on a senior secured basis against critical assets that act as collateral. Based on this strategy, most of the funds praise that they have never realized a loss, some in more than 10 years.

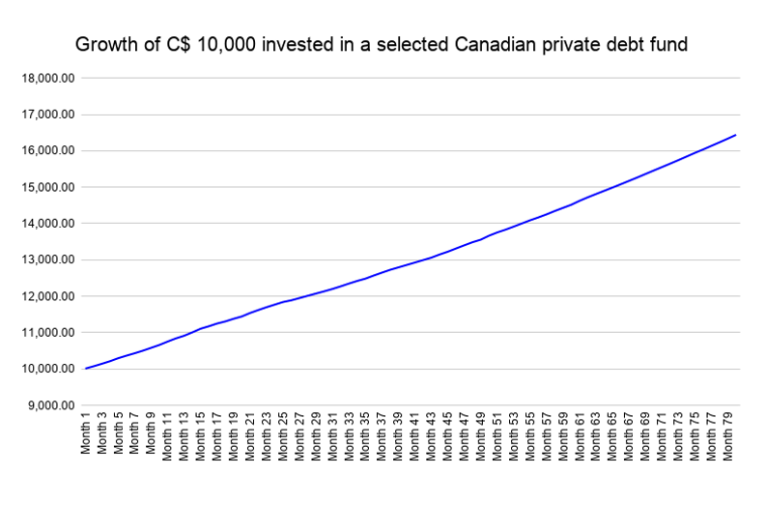

The monthly returns of most of these funds are smooth and non-dispersed. Their NAV graph looks like a straight line with a 15 degrees slope. A down month is an anomaly and non-existent in some cases. Simultaneously, their consistent net yearly returns have averaged 8% during the last five years. Those track records are reminiscent of Bernies Madoff’s performance.

According to some fund managers, those funds considered the best-in-class provide mark-to-market valuations to the funds’ assets according to IFRS 9. This translates into the possibility that the value of the loans goes up or down. International Financial Reporting Standards (IFRS) establishes the framework to assess financial instruments’ fair value and how they should be impaired.

By performing due diligence on some of these funds, investors will identify several loans that have gone sour. Evidence shows how these funds have extended credit to (a) loss-making businesses with an unsustainable level of debt, (b) companies facing fraud accusations, (c) finance failed acquisitions, (d) related parties and (e) businesses that end up going into restructuring.

Investors should understand and confirm how those private loans are valued. Having senior security and collateral doesn’t mean that the funds’ investments are risk-free. As said by renowned distressed investor Howard Marks, “senior creditors are only protected if there’s a lot of debt and equity below them.”

There is a contradiction between these funds’ performance and the quality of the investments they have made. Investing in private credit is a negative art. Mr. Marks explains, “you improve your performance in credit not through which good credits you buy, but through what you exclude.” Some of these funds have not excluded bad loans and continue to amend them to keep the companies afloat.

The premium returns and lack of volatility offered by these funds should not be received as positive news. Instead, those signs should raise our level of skepticism. Investors must understand the risks associated with those investments and the check and balance mechanisms to monitor them. Hopefully, the senior secured loans strategy doesn’t end as Madoff’s split-strike conversion strategy.