Lessons from Bridging: The Myth of Senior Security

“Lenders are used to the idea that so-called ‘first-lien’ debt grants them priority over the borrower’s assets should it go bankrupt. But Moody’s analysis of defaults during the pandemic shows that first-lien lenders are losing nearly twice as much of their capital as they used to: the average recovery rate in 2020 was 55%, compared with a long-term average of 77%” – The Economist. June 9th, 2021 edition.

The high yield investments made by Bridging and other private debt funds increase the probability of a permanent capital loss. Some private debt managers, such as David Sharpe, say that they can avoid losses and deliver premium returns. But how? Thanks to their strategy of lending to underappreciated businesses on a senior-secured basis. However, having senior security doesn’t shield any lender from realizing losses.

Since Luca Pacioli published his text describing the double-entry bookkeeping system, people in business have known that assets are equal to liabilities plus equity. That equation is represented in what we commonly know as a balance sheet. Its name derives from the fact that it is always balanced. The left side of a balance sheet shows the asset, and the right side shows the liabilities plus the equity. One side cannot exist without the other. If the left side value increases or decreases, the right side will change in the same direction and magnitude. Both sides move in tandem.

Having seniority in a capital structure means you get paid first if the company gets in financial trouble. When a secured loan is executed, the borrower pledges certain assets or cash flows as collateral to the lender. The latter will have an interest on the collateral until it gets fully repaid. However, the management of the company will retain control over the assets. Their decisions in an ongoing business will have consequences on the value of the assets that act as collateral.

Once again, we will rely on the wisdom of renowned credit investor Howard Marks. He explains best how senior security works.

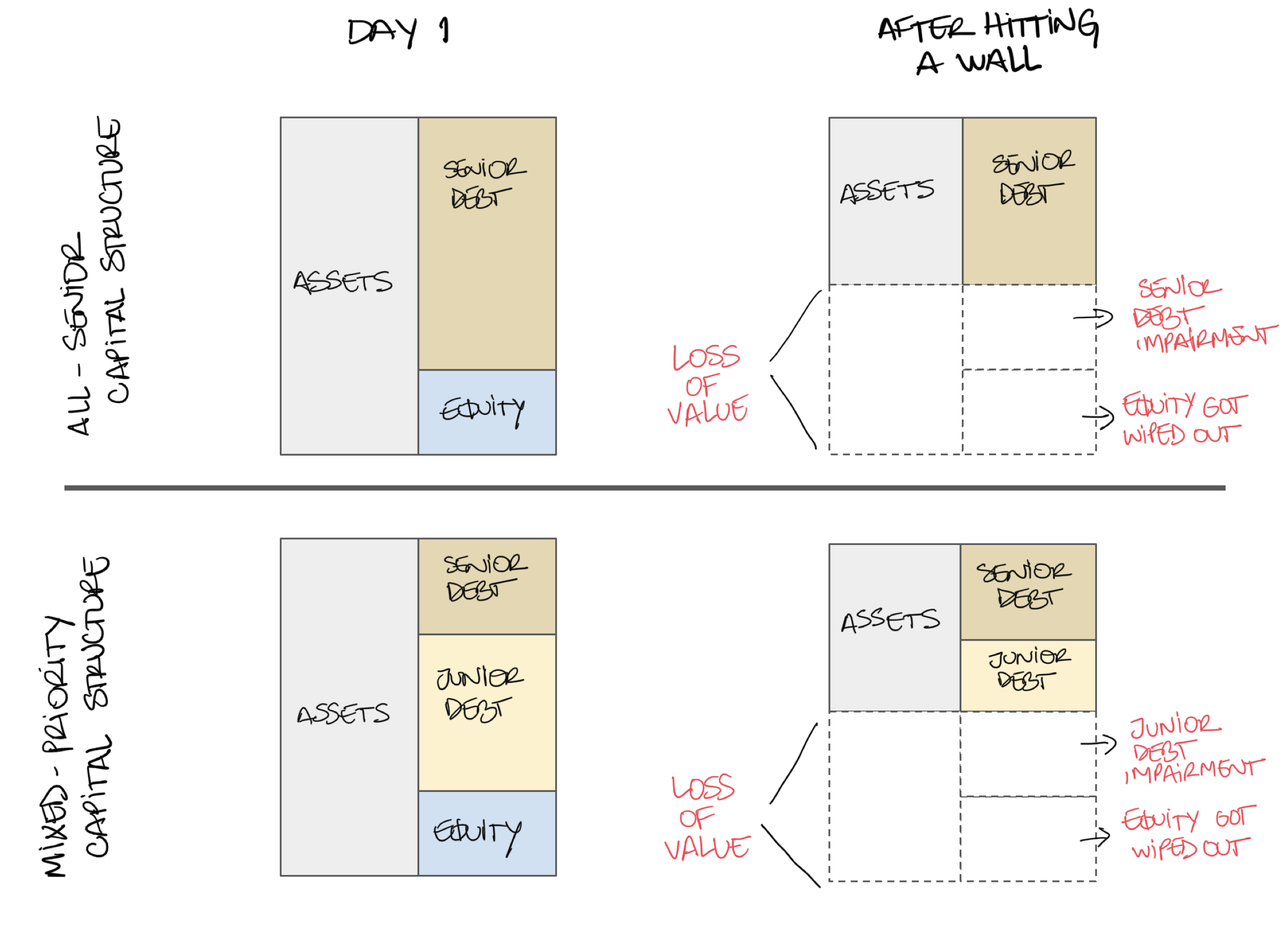

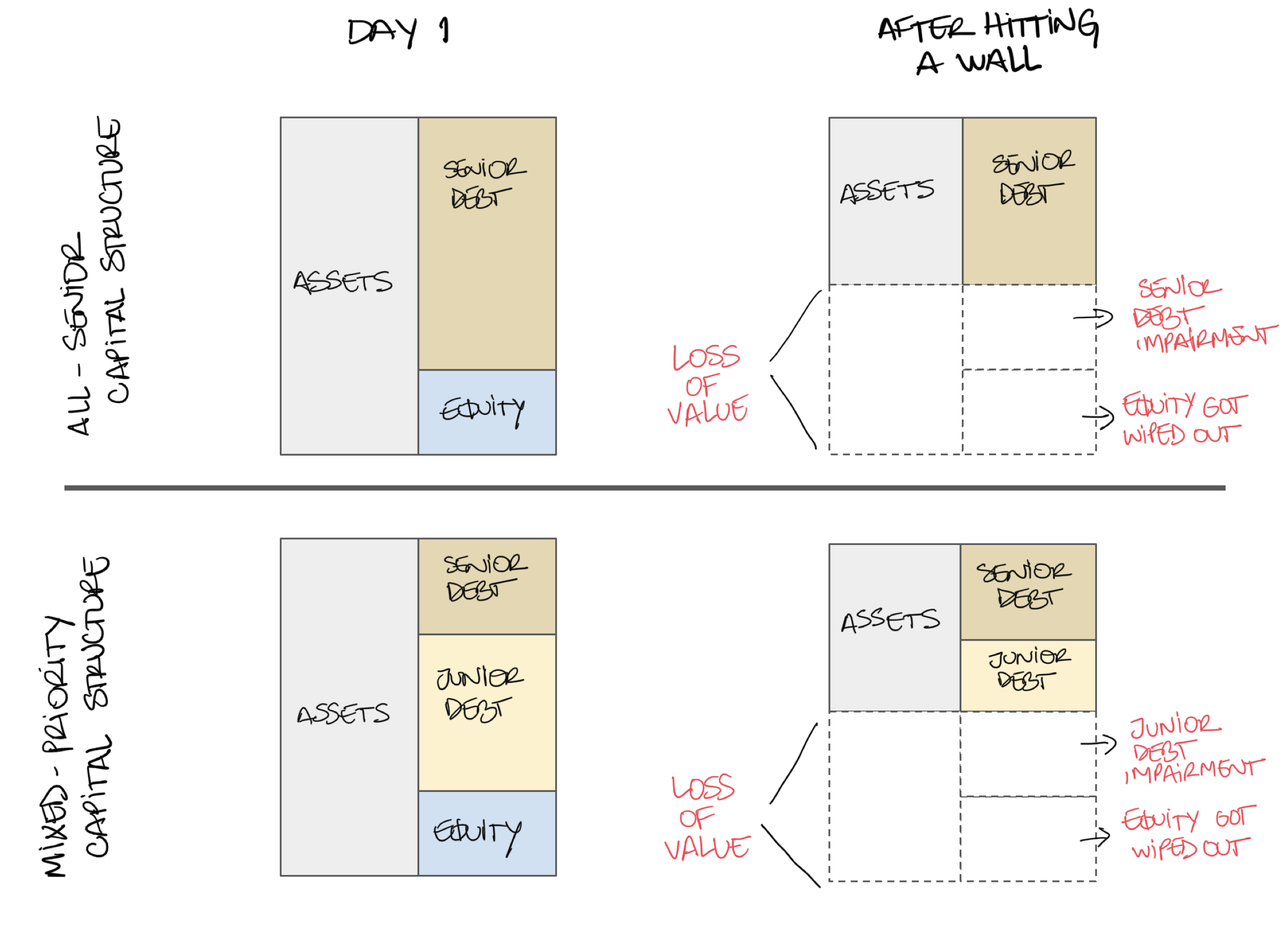

“… nowadays capital structures contain a higher percentage of senior or first lien debt. On the surface, this sounds like a source of protection for lenders. But my usual reaction is to ask, “Senior to what?” Seniority is only protective if there’s substantial cushion from junior securities. In other words, senior creditors are only protected if there’s a lot of debt and equity below them. An all-senior capital structure merely means all the senior lenders lose money together.”

The following graph shows the difference between having a substantial cushion and an all-senior capital structure.

Even when some private debt managers finance undercapitalized entities, they say that if their borrower’s business hits a wall and runs into trouble because of a failed acquisition, a pandemic, a scam or a series of bad management decisions, they will have no problems. They explain that in a fire sale of the assets that act as collateral, they will collect more money than they are owed. But this generates another hurdle to enforce their security and recoup the lender’s money. There are many examples, in the private debt space, of fire sales that yield unfavourable results.

Many private debt lenders are secured against collateral such as property plants and equipment, mineral interests, contract rights, or intellectual property. Obtaining the value of those assets is not as simple as getting a quote on Bloomberg. So when a business hits the wall and asks a court for creditors’ protection the secured lender will ask for a fire sale. The answer for the price discovery of the collateral is a Sales and Investment Solicitation Process (SISP).

As an example of a SISP, The Globe and Mail reported that Allied Track Services Inc owed around $100 million to Bridging Finance on a senior-secured basis. A credit agreement was initially executed in March 2017 and restated in November 2017. In January 2021, under a court-supervised proceeding KSV Restructuring Inc, as Proposal Trustee, initiated a SISP for the loan collateral.

As part of the SISP, KSV distributed a letter to 106 potential purchasers and investors detailing the acquisition opportunity of the assets. Twelve parties showed interest and executed a confidentiality agreement to access a data room to perform their due diligence. Four interested parties engaged in meetings with management.

After a month-long process, KSV didn’t receive any binding offers. Just two parties submitted non-binding letters of intent to purchase the assets—neither of the offers would have satisfied the secured debt. Then an entity related to Bridging assumed the debt owed to them and used it to pay for the assets. The Globe and Mail explained it best, “Bridging had to swap its debt for equity in Allied – which no one else seemed to want.”

Executing a SISP is the closest it gets to a fire sale. In the case of Bridging and Allied Track Services, even when the loan was senior secured, the collateral was not sufficient to cover the outstanding debt. Swapping senior debt for equity – which no one else seemed to want, is a frequent and unfavourable outcome of dealing with the high-risk loans that carry double-digit interest rates.

No one can foresee the future, and if they did, surely they would not be a private debt manager. As the world turns many times, the market environment changes, and managers’ decisions affect the value of any asset in time. It doesn’t matter if it is called senior-secured, first-lien, over-collateralized or super-priority; what will count for the credit investor is how much cushion a loan has below the capital structure to absorb any losses. Moreover, accessing and monetizing the collateral is not as simple as listing it on eBay. Private debt funds’ investors should be aware of these realities.

We have learned from Bridging that the risk-return proposition of a private debt fund increases the probability of a permanent loss of capital. We also learned from Bridging that senior security and the presence of collateral don’t guarantee any protection against losses. These lessons should help investors to increase their sense of disbelief. With an increased level of skepticism, the next lesson from Bridging will show how to scrutinize a private debt fund.

Disclaimer: This article is not investment advice and represents the opinion of the author.

Sources

Reports to Court from KSV Restructuring Inc as Proposal Trustee of Allied Track Services Inc.

What’s under Bridging Finance’s hood? A rare peek at the firm’s struggling loans from The Globe and Mail.

Howard Marks’ memo titled “An update” of 2020.