Why Ninepoint sold its stake in the Bridging Income Fund

Why Ninepoint sold its stake in the Bridging Income Fund

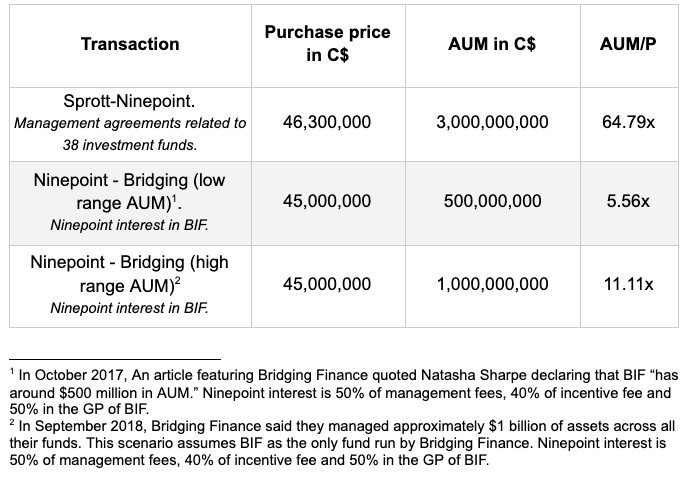

Even though details of the transaction have not been disclosed – like AUM and revenues – we can imply the valuation multiples based on public information and commonly used metrics. When comparing the trade between Sprott and Ninepoint and then between Ninepoint and Bridging, we can observe a material difference in the multiples applied.

The price offered by Bridging Finance provided a unique opportunity to Ninepoint. By offloading their stake in BIF, which was signaling trouble while defying economic laws, Ninepoint received proceeds to offset more than 95% of the financing obtained for the Sprott acquisition. That might explain why Ninepoint sold their stake in BIF.

However, according to the OSC, most of the funds used to pay Ninepoint came from investors. If the OSC allegations are confirmed, Bridging’s receiver will probably scrutinize the deal between Ninepoint and Bridging to verify an arm’s length transaction, given the multiples discrepancy between the comparable transactions.

By paying such a high premium, Bridging Finance had no margin of safety; they had no room for mistakes. But instead of conducting their business prudently, they began to enter into riskier and more concentrated investments, like extending more than $140 million to MJardin and increasing their exposure to McCoshen to $200 million. The pressure to keep making the numbers escalated, pushing them towards collapse.

Ninepoint got a great deal by selling their interest in BIF. As a result, they realized a significant profit while avoiding an in-house crisis. But they seem to fail to extend their concerns to investors who trusted their brand. Ninepoint will continue to operate in the turbulent waters of private debt. If consistent with his criteria, Mr. Wilson might soon be facing negotiations involving some of the other funds they oversee.

Disclaimer: This article is not investment advice and represents the opinion of the author.