What should Bridging Finance’s investors expect?

“It is not the first mistake that’ll kill you. It’s the second, the third, and the cover-up of all three” – Marianne M. Jennings

After the actions enforced by the OSC on Bridging Finance, investors in those funds will start questioning when they will get their money back. But the question shouldn’t be when, but how much will they get back? Sadly, investors in these funds will realize losses contrary to Mr. Sharpe’s “track record” of no credit losses.

Bridging Finance portfolio comprises loans to loss-making business with unsustainable debt and loans structured to hide losses from failed transactions. As implied by the OSC, the managers used financial engineering to deceive investors because they utilized the funds as their checking accounts.

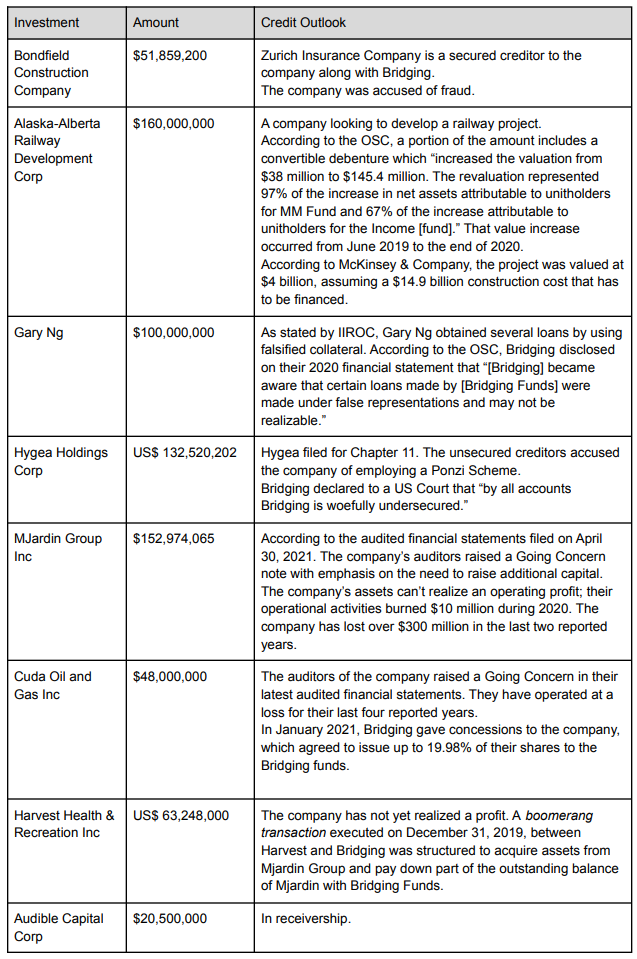

According to the OSC, the funds managed by Bridging Finance had $ 1.76 billion in assets under management as of December 2020. Some of the investments made by the funds were:

Most of the identified loans are non-performing and should be impaired under IFRS 9. Many of those entities have not serviced interest payments, capitalizing the interest on the loan after concessions made by Bridging Finance. As said by some private debt managers: “Making a loan is easy. Getting out is the hard part.”

So how was Bridging funding their monthly distributions to investors? Those distributions should have been in the order of $100,000,000 per year. One possibility is that they used the old method of borrowing from Peter to pay Paul, or better said, by running a Ponzi scheme.

As said by David Sharpe, their loans were distributed by IIROC’s dealer channel. Likely, motivated by juicy fees, many advisors put their fiduciary duty aside. Bridging proposition sounded too good to be true. Skepticism should have led them to perform due diligence that would have raised several red flags.

Unitholders of the Bridging Finance funds should expect losses on their investment. The magnitude of the losses is hard to estimate, but based on the evidence, it will be significant. Investors should be aware that they might face clawbacks if they realized any early profits from their investments in the Bridging funds, as it happened to many victims of Madoff.

The alternative investment space provides opportunities to enhance yields by increasing risk. Hopefully, this event will lead investors and financial advisors to increase their sense of disbelief. Even though we now know that the OSC is policing the private lending space, we as investors should make their life easier and avoid investments that sound too good to be true.

Disclaimer: This article is not investment advice and represents the opinion of the author.